Paycheck Explained: Where the Money Actually Goes

Your salary gets a lot of attention, but your take-home pay is what really matters for daily life. Knowing the difference helps you budget effectively, avoid surprises, and make intentional financial choices, like saving or investing.

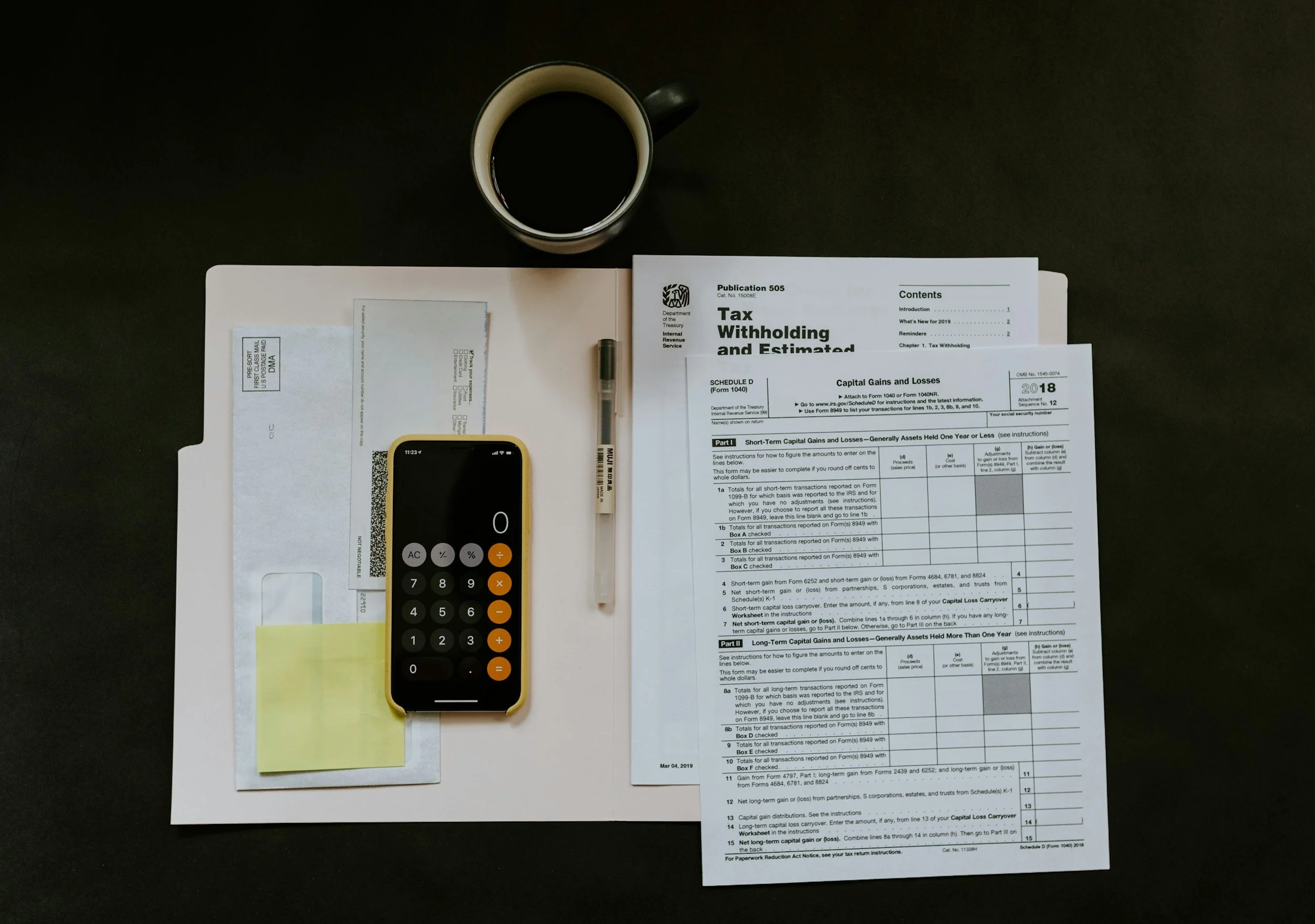

Common Tax Mistake That Costs You: Understanding Your W-4

Your W-4 is more crucial than most people think. Filling it out correctly and updating it when your life changes helps you avoid surprise tax bills and keeps more of your money working for you all year long.

Side Hustles & Taxes: What Counts as a Business (And Why It Matters)

Side hustles are excellent—they provide flexibility, the potential for extra income, and help break up the weekly routine. But they also come with tax responsibilities. Treat your side gigs like a real business by keeping good records and knowing what the IRS expects. Doing so can help you maximize legitimate tax benefits and avoid surprises.

Federal Taxes Explained With a Basic Formula

Filing taxes for the first time can feel overwhelming, especially when every form seems to speak its own language. But here’s a basic individual tax calculation that follows a straightforward process.

401(K) Basics: Setting Aside Money for the Future

A 401(k) is one of the simplest and most effective tools for building long-term wealth, especially when you start early. Contribute as much as you can, claim your employer match if available, and let time and compound growth do the rest.

Employee Benefits: An Overview

Your salary is only one part of your total compensation. Employee benefits, such as health insurance, paid time off, retirement plans, disability coverage, and more, often add thousands of dollars in value.

Inflation: What It Means for Everyday Spending

Inflation matters because it affects how much your money can buy. Inflation doesn’t always move in one direction. But as prices rise, every dollar buys less than before.

Budgeting That Actually Works: Free Downloadable Template

Creating a Budget? A cash-flow management system, aka a budget, gives you control before bad habits and debt take over. It’s essential to know what’s coming in, what’s going out, and how to make room for the things that truly matter to you.