We Plan for Emergencies. What About Lost Income?

Disability insurance is often overlooked, often somewhere wedged between health insurance, emergency funding, and life insurance. Yes, cash cushions and health benefits matter. Still, some quietly assume savings alone will carry them through any setback. Others avoid certain insurance policies altogether, believing premiums are wasted if no claim is filed. That logic sounds good until income is interrupted.

Cash Management: Every Dollar Has a Purpose

Cash works best when it is assigned roles. Standard practice calls for a three-bucket approach: an operating account, a reserve account, and a pool of money set aside for opportunities. Each bucket has a purpose.

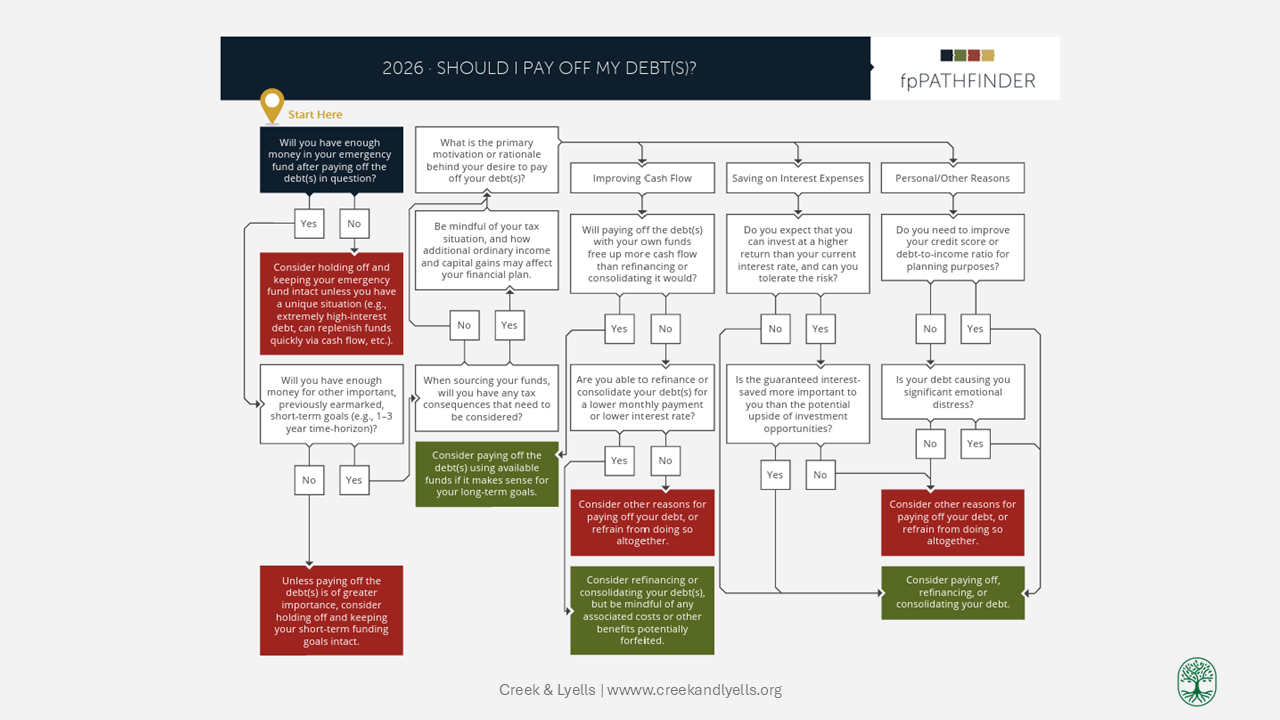

Save or Pay Down Debt?

The honest answer is that it depends. Follow this workflow to see what might be a good fit for you. But remember, there may be moments along your financial journey when you have to (temporarily) go against conventional wisdom.

Same Debt, Different Payoff Experience: Snowball vs Avalanche

The snowball can help if debt feels heavy or progress feels slow. Early wins often build momentum and make the process feel more manageable. The avalanche may be a better fit if cash flow is stable and you can handle larger upfront payments. Progress may feel slower at first, but you’re targeting the most expensive debt sooner.

Financial Moments That Can Shape Adulthood

Identify the life stage you’re in. Make one adjustment that moves you in a positive direction. Financial independence isn’t about having everything figured out. It’s about knowing what comes next and preparing just enough to meet it confidently.

Pick Two Goals and Build Around Them

Pick one or two goals to focus on for the first half of the new year. Not 5. Not everything. Revisit them regularly. Adjust as life changes. Progress isn’t about perfection; it’s about alignment. Adulthood isn’t about having it all figured out. It’s about making clearer choices, building confidence step by step, and giving yourself access to a future that truly fits your life.

Turn Financial Goals Into Action You Can Start Now

Goal planning isn’t about predicting your entire future. It’s about making today’s choices more intentional. When your goals are clear enough to act on, even small steps can build confidence, momentum, and real progress.

A Simple Rule Behind a Strong Credit Score

The key to maintaining a good credit record is to pay everything on time. Stay aware of your debt level, avoid owing more than you can repay, and recognize that digging yourself into a deep financial hole can make it very hard to get out.

Paycheck Explained: Where the Money Actually Goes

Your salary gets a lot of attention, but your take-home pay is what really matters for daily life. Knowing the difference helps you budget effectively, avoid surprises, and make intentional financial choices, like saving or investing.

Paying for College: What to Know Before You Decide

There’s no perfect way to pay for college. What matters is your awareness—that is, knowing your options, understanding the tradeoffs, and making choices that match your situation. Education is an investment in yourself, and careful planning can help you protect both your goals and your peace of mind.

Dollar Cost Averaging: A Steady Approach to Investing Over Time

Diversification and asset allocation help spread out risk, while dollar-cost averaging keeps your savings steady and allows you to take advantage of market fluctuations. None of these strategies guarantees profits, but together they can help you stay invested without reacting emotionally to every headline and may reward patience and discipline over time.

Where Common Investments Typically Fall on the Risk Spectrum

A simple way to visualize how various investments typically differ in risk. View risk pyramid.

Investment Risk Isn’t Just “What If I Lose?”

Risk isn’t just, “but I might lose money?” It’s “what could affect my money today and in the future, and do I understand it?” When you learn the difference between market-wide risk and investment-specific risk, you can build a strategy that feels calmer, smarter, and more realistic.

A Small Update That Brings Clarity for You and Your Loved Ones

Estate planning often begins with simple steps and doesn't always require complex documents. Taking a few minutes to review and update your beneficiaries can protect your intentions, your loved ones, and your peace of mind. Small actions today can avoid big problems tomorrow.

Emergency Fund: Financial Breathing Room When Life Happens

Building an emergency fund isn’t about having everything figured out—it’s about giving yourself breathing room. Even small savings can lower stress, safeguard your goals, and help you stay in control when life gets unpredictable. Start where you are, stay consistent, and let your safety net grow with you.

Common Tax Mistake That Costs You: Understanding Your W-4

Your W-4 is more crucial than most people think. Filling it out correctly and updating it when your life changes helps you avoid surprise tax bills and keeps more of your money working for you all year long.

Side Hustles & Taxes: What Counts as a Business (And Why It Matters)

Side hustles are excellent—they provide flexibility, the potential for extra income, and help break up the weekly routine. But they also come with tax responsibilities. Treat your side gigs like a real business by keeping good records and knowing what the IRS expects. Doing so can help you maximize legitimate tax benefits and avoid surprises.

Federal Taxes Explained With a Basic Formula

Filing taxes for the first time can feel overwhelming, especially when every form seems to speak its own language. But here’s a basic individual tax calculation that follows a straightforward process.

Roth IRA: A General Overview

Roth IRA contributions, if eligible, offer tax-free growth, flexibility, and long-term advantages that are especially useful for building wealth. Even small contributions today can grow into substantial tax-free income in the future.

Understanding Investment Funds in 5 Minutes (Yes, Really!)

You don’t need a finance degree to understand investment funds. Learning just a few basics can help you identify what you’re investing in or at least have an informed conversation with an investment professional.