We Plan for Emergencies. What About Lost Income?

Disability insurance is often overlooked, often somewhere wedged between health insurance, emergency funding, and life insurance. Yes, cash cushions and health benefits matter. Still, some quietly assume savings alone will carry them through any setback. Others avoid certain insurance policies altogether, believing premiums are wasted if no claim is filed. That logic sounds good until income is interrupted.

Cash Management: Every Dollar Has a Purpose

Cash works best when it is assigned roles. Standard practice calls for a three-bucket approach: an operating account, a reserve account, and a pool of money set aside for opportunities. Each bucket has a purpose.

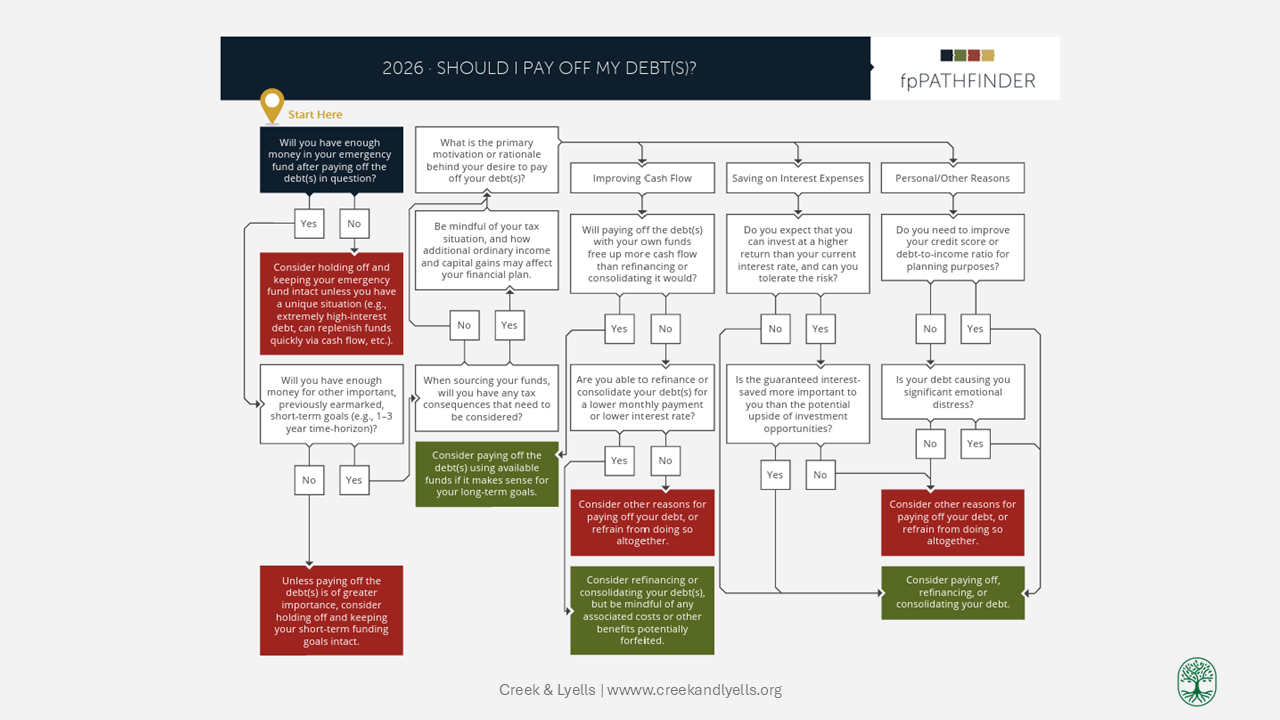

Save or Pay Down Debt?

The honest answer is that it depends. Follow this workflow to see what might be a good fit for you. But remember, there may be moments along your financial journey when you have to (temporarily) go against conventional wisdom.

Same Debt, Different Payoff Experience: Snowball vs Avalanche

The snowball can help if debt feels heavy or progress feels slow. Early wins often build momentum and make the process feel more manageable. The avalanche may be a better fit if cash flow is stable and you can handle larger upfront payments. Progress may feel slower at first, but you’re targeting the most expensive debt sooner.

Financial Moments That Can Shape Adulthood

Identify the life stage you’re in. Make one adjustment that moves you in a positive direction. Financial independence isn’t about having everything figured out. It’s about knowing what comes next and preparing just enough to meet it confidently.

Pick Two Goals and Build Around Them

Pick one or two goals to focus on for the first half of the new year. Not 5. Not everything. Revisit them regularly. Adjust as life changes. Progress isn’t about perfection; it’s about alignment. Adulthood isn’t about having it all figured out. It’s about making clearer choices, building confidence step by step, and giving yourself access to a future that truly fits your life.

Turn Financial Goals Into Action You Can Start Now

Goal planning isn’t about predicting your entire future. It’s about making today’s choices more intentional. When your goals are clear enough to act on, even small steps can build confidence, momentum, and real progress.

A Simple Rule Behind a Strong Credit Score

The key to maintaining a good credit record is to pay everything on time. Stay aware of your debt level, avoid owing more than you can repay, and recognize that digging yourself into a deep financial hole can make it very hard to get out.

Dollar Cost Averaging: A Steady Approach to Investing Over Time

Diversification and asset allocation help spread out risk, while dollar-cost averaging keeps your savings steady and allows you to take advantage of market fluctuations. None of these strategies guarantees profits, but together they can help you stay invested without reacting emotionally to every headline and may reward patience and discipline over time.

A Small Update That Brings Clarity for You and Your Loved Ones

Estate planning often begins with simple steps and doesn't always require complex documents. Taking a few minutes to review and update your beneficiaries can protect your intentions, your loved ones, and your peace of mind. Small actions today can avoid big problems tomorrow.

Emergency Fund: Financial Breathing Room When Life Happens

Building an emergency fund isn’t about having everything figured out—it’s about giving yourself breathing room. Even small savings can lower stress, safeguard your goals, and help you stay in control when life gets unpredictable. Start where you are, stay consistent, and let your safety net grow with you.

A Simple Guide to Compound Interest

Compound interest, from a savings and investment perspective, occurs when you earn interest on your interest. This “interest on interest” effect becomes an important factor in long-term growth.

What's the Story Behind Medical Billing?

Understanding when copays, deductibles, coinsurance, and out-of-pocket maximums occur helps you grasp your bills and, hopefully, boosts confidence in navigating the healthcare system, especially as you start managing your own coverage.

Debt Isn’t All Bad: A Quick Look at Student and Car Loans

Debt isn't something to fear or feel ashamed of; it’s just a tool. When you understand how student loans, car loans, or any loans work, you can use them to support your future instead of complicate it.

Credit Cards: Know This Before You Apply or Swipe

Credit cards aren’t “bad”—they’re tools. Used wisely, they help you build the credit profile you’ll need for bigger goals. Used without a plan, they can make adulthood more stressful than it needs to be. You have so much ahead of you; let your credit habits support your future, not complicate it.

Inflation: What It Means for Everyday Spending

Inflation matters because it affects how much your money can buy. Inflation doesn’t always move in one direction. But as prices rise, every dollar buys less than before.

Budgeting That Actually Works: Free Downloadable Template

Creating a Budget? A cash-flow management system, aka a budget, gives you control before bad habits and debt take over. It’s essential to know what’s coming in, what’s going out, and how to make room for the things that truly matter to you.

Banks, Credit Unions, and Online Banks: What Fits Your Needs Best

The bank you choose can either support your goals or slow them down. It should also make your life easier, not more expensive.